If you are about to turn 65 in North Carolina then you are one of many that will be looking at your options for medicare supplement plans in NC. North Carolina currently has roughly 9.5 million residents and approximately 14% (1.4 million) of these are seniors over the age of 65. It is projected that by 2035 approximately 20% of North Carolina residents will be over the age of 65. Therefore it is imperative that you know what your options are under Medicare.

Understanding Your Medicare Supplement Plan Options

North Carolina Medicare supplement plans offer the same availability as 47 other states (Massachusetts, Minnesota, and Wisconsin have different types of standardized Medigap plans). There are currently 10 standardized Medicare supplement plans that are available in North Carolina and these plans are identified by the letters A through N. Only Wisconsin, Minnesota, and Massachusetts offer different type of standardized Medigap plans.

North Carolina Medicare supplement plans offer the same availability as 47 other states (Massachusetts, Minnesota, and Wisconsin have different types of standardized Medigap plans). There are currently 10 standardized Medicare supplement plans that are available in North Carolina and these plans are identified by the letters A through N. Only Wisconsin, Minnesota, and Massachusetts offer different type of standardized Medigap plans.

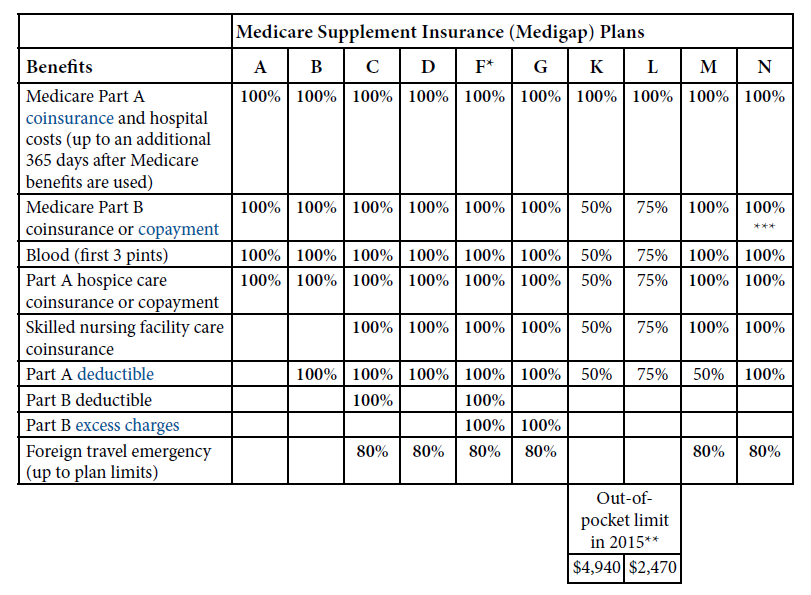

Standardization of plans is a very important concept that you need to understand before choosing your North Carolina Medicare Supplement Plan. Standardization means that all plans of the same letter regardless of the carrier are identical in coverage. Therefore Plan F with Aetna is the exact same as Plan F with AARP. The only difference is the carrier name and the monthly premium. The picture below is an excerpt taken from "The Choosing A Medigap Policy" distributed each year by CMS (Center for Medicare and Medicaid Services) and is found on page 9 and states exactly what we are talking about…

"standardization of Medicare Supplement Plans simplifies comparing companies plans"

Also with a Medicare Supplement Plan you still have Original Medicare Part A and B. This is important to know because regardless of who your Medigap plan carrier is, you can see any doctor in your area or in the entire country as long as they accept Medicare they will accept your Medicare Supplement Plan regardless of who the carrier is. There are no networks with a Medicare supplement your network is Medicare.

When Can I Enroll in a Medigap (Medicare Supplement) Plan?

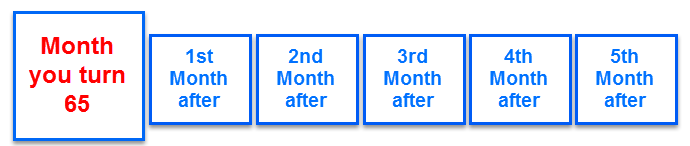

Your Medicare open enrollment period begins the the first day your are both 65 or older and enrolled in Medicare Part B. Once this condition is met this period will last for the next six months. During this time you are able to enroll in any Medicare supplement plan that you choose, from any carrier and you will not have to answer any health questions (this means that you cannot be denied coverage during this period due to health issues). This is the best time to enroll in a Medicare Supplement Plan in NC.

If you are already over 65 and on Medicare Part B you can still apply for another plan at any time during the year. However when you do this you will be required to answer health questions in order to change plans.. Insurance companies can deny you coverage based on your current health. Things like cancer, stroke, COPD, Alzheimer's, Parkinson's, etc will prevent you from being able to enroll in a Medicare Supplement Plan. If you do not have any major illnesses chances are that you will be able to change your coverage with little to no problem.

Do I Need a Medicare Supplement Plan in NC?

The purpose for a Medicare Supplement Plan is to do exactly as it says supplement Medicare. Without having a Medicare supplement plan in place while on Medicare part A and Part B only you are exposed to very high potential out-of-pocket costs in the event that you need medical assistance.

Let's take a quick look at what some of these expenses May entail. Medicare Part A covers your Hospital care. With Part A you have a $1,316 deductible for each benefit. If you are in the hospital for more than 60 days you will then pay a coinsurance of $329 per day for day 61 through 90 and $658 per day for days 91 and beyond.

Medicare Part B covers doctor services, surgeries, lab test, etc. Once you have met your annual Part B deductible of $183 Medicare covers 80% of the remaining bill and you are responsible for the other 20%. Please note that there is no cap limit on this 20% that you owe. For instance if you had a Part B claim a $50,000 Medicare would pay $40,000 and you would be responsible for the remaining $10,000.

By having a Medicare Supplement Plan in North Carolina in place for the above scenarios your out-of-pocket exposure would be minimal depending on which plan you were to choose.

What are the top Medigap Plans in North Carolina

As stated earlier there are 10 different Medigap choices. Below is a chart that shows what is covered by all 10 plans.

Most people choose one of the following three options.

- Plan F: This plan offers the most comprehensive coverage available has it covered 100% of what Medicare does not cover

- Plan G: This is becoming the most popular plan because it offers the best value in our opinion. Plan G covers everything that Plan F covers with the exception of your Medicare Part B annual deductible which in 2017 is $183.

- Plan N: This plan is becoming more and more popular because it still offers adequate coverage with a lower premiums when compared to plan G. however with plan in once you have met your annual deductible with Medicare Part B you will still have a co-payment of up to $20 on some office visits and up to $50 on emergency room visits. Plan N also does not cover your Medicare Part B excess charges.

Of these three plan options Plan G is by far our most recommended and selected plans by our clients.

We just established the top 3 plans for Medicare supplements. It is important to note that insurance carriers rates will vary from County to County with in North Carolina. Therefore Plan G with one carrier's rates in Charlotte North Carolina may be different than that same carriers Plan G in Wilmington North Carolina.

Choosing Your Medicare Supplement Plan in NC

When it comes time for you to select which Medigap plan is the best for you the three main things to look for as mentioned above are as follows:

- Plan type. Should you choose Plan F, G or N?

- Premiums

- Carrier name and financial strength

As we laid out above Plan G is our most purchased plan by our clients. When you do the numbers based on price plus benefits this plan outweighs all the others.

It was also mentioned above that because plans are standardized all plans with the same letter have identical benefits. Therefore premiums are usually the only difference from one carrier to another. When you are reviewing the same plan letter, premium is one of the most important factors to consider. A comparison would be shopping for a box of Cheerios...two stores have the exact same box of Cheerios but one of the stores is priced 20% less than the other store. If all other things are equal you will choose the one that costs 20% less. Please note though that we are not suggesting that you choose the lowest priced supplement of that letter. Premium plus carrier name and financial strength need to be weighed together.

Carrier name and financial strength along with the price comparisons within the same plan type will really determine which is going to be the best plan for you. Many times you will see a carrier come into the marketplace with really low premiums. They are doing what we call “buying business”. They come in with a really low monthly premium to try and snatch up a bunch of new enrollees and then because they do not have the market size of some of the larger carriers, over time you will end up seeing higher rate increases than you would with a more stable longer-term company. Therefore when choosing the carrier it is important to go with an A-rated carrier that has a substantial market share within the North Carolina Medicare supplement plan market.

What Do You Do Now?

With the above information that was just covered you should be able to make informed decision on which Medicare Supplement Plan to choose and how to choose it.

We highly recommend that you used an experienced independent broker that can show you all of the major carriers and plans that are available in your area. This will ensure you that you have access to all of the carriers and all of the rates. If you would like us to help you secure the best Medicare supplement plan in NC we would be happy to do so. Please fill out the form on this page for quote and a licensed independent representative from our company will be in contact with you shortly. We are here to help in any way we can.