Get Started on Finding Your Medicare Plans

Compare Plans

What is Medigap Plan G?

Medigap Plan G is quickly becoming one of the most popular of the 10 options for a Medicare Supplement in most states (not offered in Massachusetts, Minnesota or Wisconsin).

Medigap Plan G

What is covered under Plan G?

Medigap Plan G covers everything that Original Meidicare doesn't cover with the exception of your annual Part B deductible (in 2016 this is $166). Therefore Plan G offers you an out of pocket exposure of only $166 annually for Medicare approved expenses (does not include prescription drugs).

As you can see from the chart below this plan is essentially Plan F without paying the Part B annual deductible.

Medicare Benefits | A | B | C | D | F | G | K* | L* | M | N |

|---|---|---|---|---|---|---|---|---|---|---|

Medicare Part A coinsurance and hospital costs (up to an additional 365 days after Medicare benefits are used) | 100% | 100% | 100% | 100% | 100% | 100% | 100% | 100% | 100% | 100% |

Medicare Part B coinsurance | 100% | 100% | 100% | 100% | 100% | 100% | 50% | 75% | 100% | 100% |

First 3 Pints of blood | 100% | 100% | 100% | 100% | 100% | 100% | 50% | 75% | 100% | 100% |

Part A hospice care | 100% | 100% | 100% | 100% | 100% | 100% | 50% | 75% | 100% | 100% |

Skilled nursing facility care | 100% | 100% | 100% | 100% | 50% | 75% | 100% | 100% | ||

Part A deductible | 100% | 100% | 100% | 100% | 100% | 50% | 75% | 50% | 100% | |

Part B deductible | 100% | 100% | ||||||||

Part B excess charges | 100% | 100% | ||||||||

Foreign travel emergency | 80% | 80% | 80% | 80% | 80% | 80% |

* For Plans K and L, after you meet your out-of-pocket yearly limit and your yearly Part B deductible ($166 in 2016), the Medigap plan pays 100% of covered services for the rest of the calendar year

** Plan N pays 100% of the Part B coinsurance, except for a co-payment of up to $20 for some office visits and up to a $50 co-payment for emergency room visits that don’t result in an inpatient admission.

Why Should you Choose Medicare Supplement Plan G?

Plan G is our most recommended Medicare supplement choice. The reason why you should consider Plan G is because it is the most economically priced option that still offers minimal exposure.

Let's face it, when you are in retirement every little bit of savings matter. When comparing Plan G to Plan F your annual premium savings with Plan G more than covers the $166 out of pocket exposure. It really is a no brainer selection in our opinion.

Another reason why you should choose Plan G is the history of their rate increases tells us that Plan G's rates will increase over time much less than Plan F. In looking at data from various carriers over the year we have surmised that "on average" plan F has an annual rate increase around 8% whereas Plan G has an annual rate increase of around 3%. Over time this adds up to a lot of additional dollars.

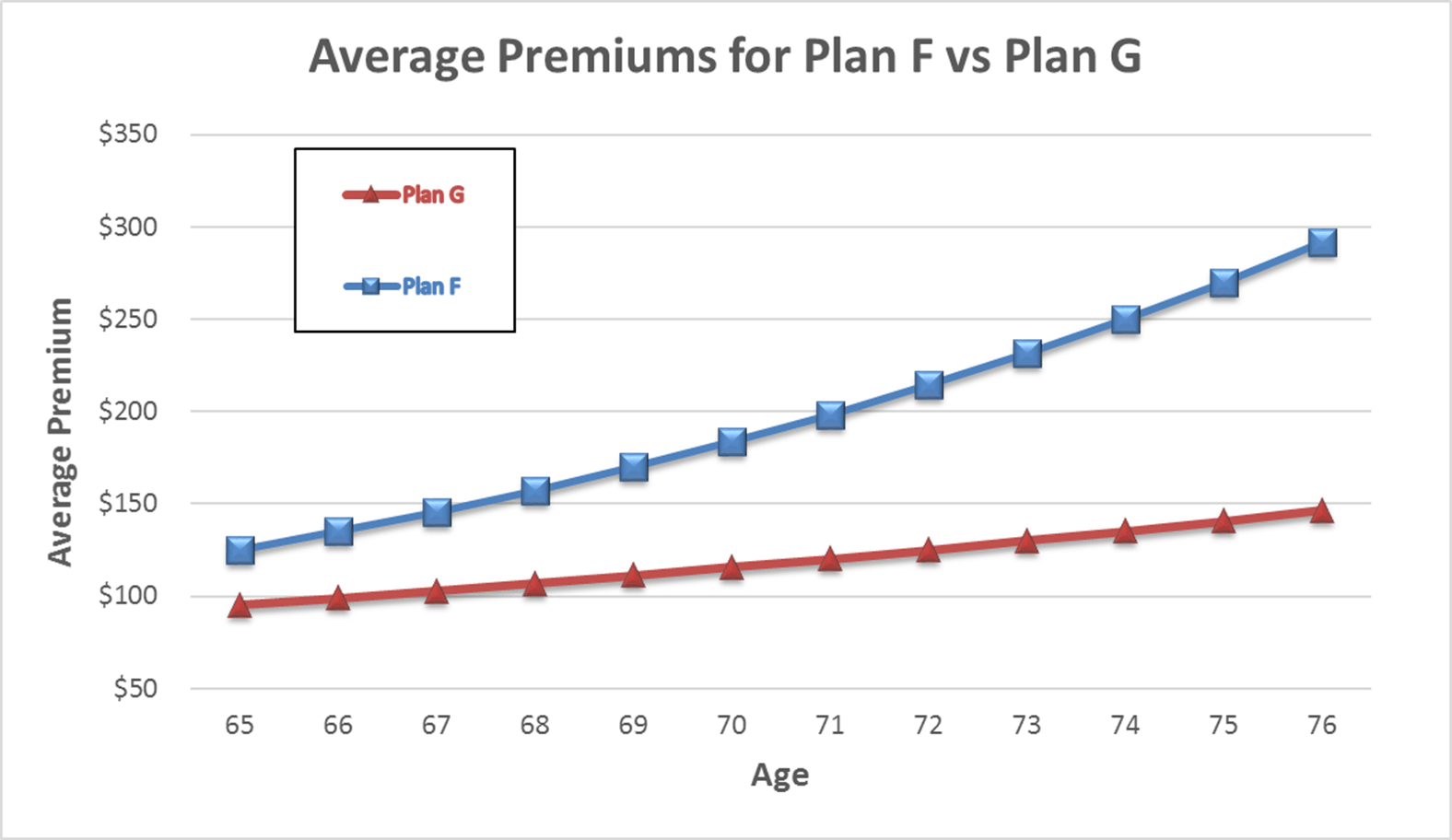

The chart below shows a hypothetical situation of a person buying a policy at age 65 in 2016 and what this policy would look like over the next 12 years with increases of Plan F and G at 8% and 3%, respectively. I think the choice is obvious.

Plan G has several advantages that impact the overall rates over time. The first is that Plan G is not a guaranteed issue policy like Plan F is. The only time you can get Plan G with no underwriting questions (health questions) is when you first enroll in Medicare Part B. This means fewer sicker people end up on Plan G as do on Plan F. With a larger number of sicker people on Plan F, rate increases tend to be higher as compared to Plan G.

Why Should You NOT Choose Medicare Supplement Plan G?

If you have been enrolled in Medicare Part B for more than 6 months in order to purchase Plan G you will have to answer health questions that may prevent you from being able to enroll in Plan G. Some common health concerns that will prevent you from passing underwriting will be if you have had a heart attack, cancer, stroke or other similar high risk illnesses.

However it should be pointed out that all carriers underwriting requirements are different so just don't assume that you can't purchase it because you have had some recent health issues. Some carriers are more lenient than others so it is best to consult with us first to see if you are eligible. A quick phone call may save you hundreds or thousands of dollars.