Medicare Part D Plans are drug plans provided by private insurance companies that are approved by Medicare. They are often referred to as Prescription Drug Plan (“PDP”) or Drug plans. All approved Medicare Part D plans should have the Medicare Rx logo.

All people with Medicare are eligible to enroll with a PDP. For those new to Medicare, they have a 7 month window to enroll in a part D drug plan. You have three months before, the month of, and three months after your Medicare Part B becomes effective. Once this time period passes, you will have to wait for the annual election period (October 15 thru December 7). If you do not sign up when first eligible, you will be assessed a penalty by Center for Medicare and Medicaid Services (CMS) - (see “Carrot and Stick” below).

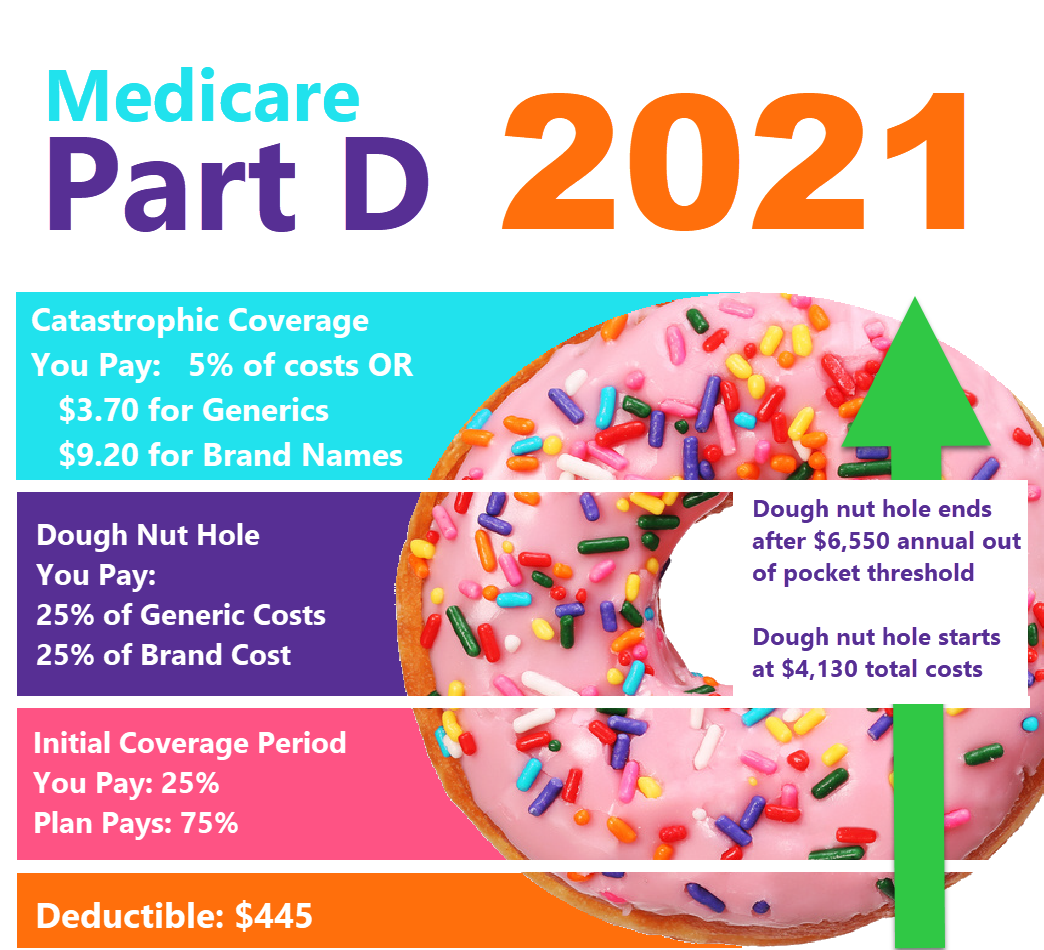

CMS requires each insurance company to offer a standard plan with mandated benefit limits. However each company can offer an enhanced version of that standard plan. These enhancements could include larger formularies, no/lower deductibles, lower copays for drugs, etc.

Costs of PDP Plans

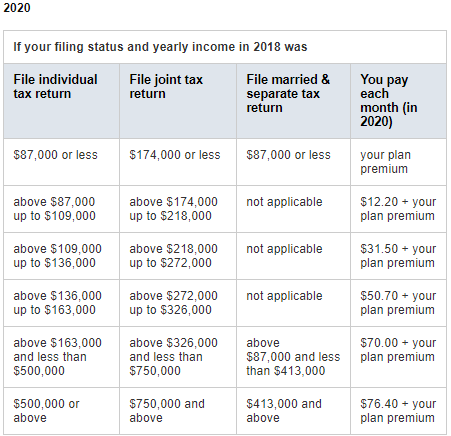

There are over 30 different carriers that offer PDP plans and each carriers monthly premiums and how they cover prescriptions vary. However it is important to know that if your modified adjusted gross income is above a certain amount, you may pay a Part D income-related monthly adjustment amount (Part D-IRMAA). Medicare uses the modified adjusted gross income reported on your IRS tax return from 2 years ago (the most recent tax return information provided to Social Security by the IRS). You'll pay the Part D-IRMAA amount in addition to your monthly plan premium, and this extra amount is paid directly to Medicare, not to your plan. The chart below lists the extra amount costs by income.

PDP Formularies

All plans have a formulary, which is a list of drugs that are covered by each plan. The formularies can vary widely and are one of the most important factors to take in to account when purchasing a PDP. There are two types, open formularies and closed formularies. Open formularies will automatically include any new drug approved by CMS. Due to the cost of automatically accepting these new high end drugs (read very expensive), many plans are switching to a closed formulary. Closed formularies select the list of drugs that are covered and do not automatically include any newly approved drugs without reviewed first. Another important factor with formularies is the annual change in drugs covered. These annual changes make it necessary for you to check to see if your medicines will be covered next year based on any changes to next year’s formulary.

Carrot and the Stick - PDP Penalty

When PDP plans were first created in 2007, the government included mechanisms to entice those seniors who were eligible (and not taking any medications) to enroll also. Most seniors who were not on any medications felt is was not necessary to pay for a PDP when they were not using it. However, the government needed those not taking medication to help offset the cost of those who were taking multiple medications. Therefore, the government introduced the “carrot and the stick.” The carrot was price reduction of medicine costs when compared to what seniors were paying before PDPs were created. The stick was a 1% penalty per month for those of you who were not signed up when you first became eligible. This penalty was based on the current year's average national price of a PDP. The penalty follows you for as long as you live. When you switched PDP, CMS would notify the new insurance carrier and require them to continue assessing the penalty. This was to encourage those not taking medication to enroll early.

PDP Penalty Example: Thomas was eligible for a PDP 3 years ago when he first turned 65 and enrolled in Medicare Part A and Part B. He was not taking any medications at the time, so decided to not enroll in a PDP. During the next annual enrollment period, Thomas decided he should enroll in a PDP just in case. Since he has been without coverage for 36 months, his penalty is 1% x 36 months = 36% of the national base premium of that year. The 36% penalty is added onto his current PDP premium. If the national average monthly PDP premium was $33; his penalty would be 36% x $33 = $11.88/month in addition to his PDP premium. This penalty is permanent and will follow Thomas no matter what PDP he chooses. CMS will require any PDP carrier to enforce the penalty. Each year the penalty will be a percentage of the current year's average monthly premium.

Comparing Medicare Part D Plans Year to Year

Comparing plans at the end of each year (AEP – Oct 15th – Dec 7th) can be quite confusing. Remember that formularies, copays, deductibles, etc change each year. If you have XYZ’s PDP this year and it worked well for you; that does not guarantee XYZ’s PDP will be a good option for you next year. You have to remember that changes in the plan for the new year can have a significant impact on how well the plan works for you the next year. You could have a medicine that is dropped from the formulary entirely. The pharmacy you like to use is no longer part of the preferred pharmacy network; thus making your medicines cost more next year.

TIP - Make sure you review your Medicare Part D coverage every year. We recommend using Medicare.gov Plan Finder Tool, or simply call Medicare directly at 800-MEDICARE. They can help you review, compare, and enroll in your Part D plan.

Want help choosing a Medicare Part D plan?

We recommend contacting Medicare directly at 800-MEDICARE. They are available to help you determine what plan will cover your medicines and keep your out of pocket costs as low as possible.

If you do use Medicare.gov Plan Finder Tool or call Medicare directly, make sure you ask about the following:

- Are all your medicines are covered by that plan's formulary (list of medicines the plan covers)?

- Are the pharmacies you use included in the analysis?

- Ask if there are any Quantity Limits, Prior Authorization, or Step Therapy for any of your medicines.