Get Started on Finding Your Medicare Plans

How and When to Enroll in Medicare

Do you feel like Medicare has more periods than a Hemingway Novel?

Well, not those type of periods. Medicare's Periods refer to when you can enroll and when you can make changes to plans. If you are first enrolling in Medicare, it can be overwhelming to make sense of, but the information below will help you keep it straight.

Different Types of Medicare Enrollment Periods

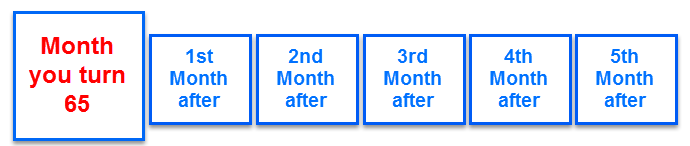

Initial Enrollment Period (IEP) - This is the seven month period when you can enroll in Medicare the first time. It begins 3 months before you turn 65, includes the month you turn 65, and ends 3 months after you turn 65. It's VERY important because during this time you can enroll in Medicare with no penalty.

You will sign up for Medicare Part A (for many this is free), Medicare Part B (premium is determined by your income 2 years prior), and a Medicare Part C or Medicare Part D plan.

TIP - Medicare has several penalties for not enrolling when you are first eligible. Please be aware because these penalties do not go away. They are assessed as long as you are on Medicare.

Open Enrollment Period (OEP) - The time for OEP is the same every year. It begins October 15th and runs through December 7th. This is when you can change Part C or Part D plans for the following year.

Common Misunderstanding - Many people believe you can only change your Medicare Supplement plan during this time also. That is not true and one of the reason we love Medicare supplement plans. Medicare supplement plans can be changed at any time during the year.

General Enrollment Period (GEP) - Oops! Did you miss your IEP? Good news, you can still enroll. You can enroll January 1 through March 31 of each year. Bad news is your coverage will start on July 1st. Double bad news....you might get a "late enrollment" period. Medicare penalties are permanent, as in forever! If you go several years without enrolling, you would be facing an additional 10% for each 12 month period you did not enroll when you were eligible.

Special Enrollment Periods (SEP) - SEPs are for situations when you have had some life event that triggers a special period where you can make changes to your plan mid year. An example would be if you decided to continue working (with employer health insurance). In this case you would most likely not enroll in Part B until you lost your group coverage. Losing that group coverage could would trigger a SEP. At that time, you could sign up for Medicare Part B. You would avoid any penalty because you had prior creditable coverage. TIP - remember to keep that paper work you receive from your employer when you leave. It might be required to prove you had prior coverage (group coverage).

Medicare Enrollment - What you need to know

Continuing to work past retirement age - If you are covered through an employer’s group coverage, you will want to talk to your HR department to learn about your company’s options in your situation. In some cases, Medicare will be a more attractive option for you. In other cases, the coverage offered through your employer might be a better fit until you retire.

In most cases, if you are still being covered by your employer coverage, you will want to defer enrolling in Medicare Part B until you lose group coverage. Talk to your HR department as we have heard some situations where the employer required the employee to enroll in Part A and Part B when eligible.

Already enrolled in Medicare Part A and receiving Social Security, you will be automatically enrolled in Part B. You should receive your new Medicare Card within a couple months of you turning 65. The new card will have an effective date for Part A and a different effective date for Part B.

Once you have your card with the new Part B effective date, you will need to start shopping for a Medicare supplement plan.

Retiring and starting Medicare - First congrats on retiring. As a reward, you get to manually enroll in Medicare Part A and Part B. Don’t worry, it’s not hard. See the box to the right for "3 Ways to Enroll in Medicare."

Remember enrolling in Medicare Part B starts a clock, which is a 6 month window when you can enroll in any Medicare supplement plan with no health questions (“underwriting” in insurance terms). It's a great way to make sure you get coverage with no issues.

Many insurance companies will allow you to submit an application before your Part B starts. Some as early as 6 months before you turn 65.

3 Ways to Enroll in Medicare

- Online - Visit Social Security website to submit your application online. If you are not receiving benefits (social security) yet, you can chooe to apply for Medicare coverage only

- In-Person - Visit your local Social Security office to apply in person

- By Phone - Call Social Security at 800-772-1213 (TTY users, dial 800-325-0778), Mon - Fri from 7am to 7pm.

Why pick a Medicare Supplement Plan during your Initial Enrollment Period (IEP)

It's important to choose a Medicare supplement Plan during the first 6 month after enrolling in Medicare Part B. During this time you can pick any plan you would like. In IEP, Insurance Companies:

- Cannot refuse to sell you any Medigap Plan they offer

- Cannot charge you more than they charge someone with no health issues

- Cannot make you wait for coverage to start

TIP - We recommend you submit your application at least 1 month before your Part B coverage starts. This allows you time to get your cards and material in hand before Part B starts.

Enrolling In Medicare: Case Study

Mark is turning 65 in August of this year. He has group coverage through his employer, but will be retiring in August.

Mark's Medicare Part A premium is free because of the number of quarters he has paid into Medicare via taxes. His Part B premium will be determined based off his tax return from 2 years prior. When he enrolls in Medicare Part B via online, phone, or in person; they will help him determine what he will pay for Part B.

Enrolling in Medicare Part A, B, and D: Mark has 3 months before he turns 65 in August, the month of August, and 3 months afterwards to enroll in Medicare Part A, B and D with no penalty. He will contact Social Security to enroll in Part B. He can call Medicare (800-MEDICARE) directly to review his options and help him enroll in Part D (Medicine) coverage.

Choosing a Medicare Supplement Plan: Mark wants to use a Medicare supplement (medigap) plan to cover the gaps in his Part A and Part B coverage. Since his Part B premium will be effective the 1st of the month he turns 65, he reached out to MyMedigapConsultant.com. We reviewed all his options and decided on a particular insurance company and Medicare plan. We submitted an application to his insurance company of choice 3 months before August. Some insurance companies will accept application up to 6 months before Mark turns 65.

Mark received his cards and welcome packets. Since Mark enrolled in August, he will also need to review his Part D coverage again in OEP (Oct 15th - Dec 7th). He can again call Medicare at 800-MEDICARE. They will review all the plans available to him and help him change plans for the upcoming year if necessary. Most Medicare supplement plans change rates on the anniversary, so we have Mark scheduled to review his plan again in June of the following year. Mark is all set....Be like Mark.